Article

Bhad Bhabie’s Crypto Token: A Cautionary Tale for Investors

New to OnlyFans? Limited offer - 60% off for 31 days!

Bhad Bhabie’s Crypto Token: Performance, Decline, and Lessons from Celebrity Coins

Overview of Bhad Bhabie’s $BHAD Project

Danielle Bregoli – better known as Bhad Bhabie – launched her own cryptocurrency token called $BHAD in early 2025. Bhabie positioned $BHAD as a community-driven token with a purpose, aiming to support causes close to her heart: funding cancer research and furthering her music career (Bhad Bhabie Launches $BHAD: A Community Token Built with Purpose By Chainwire) (Bhad Bhabie Launches $BHAD: A Crypto Token with a Purpose). Unlike many celebrity crypto endeavors accused of being cash-grabs, $BHAD was promoted with a focus on transparency and community ownership, with Bhad Bhabie even pledging 50% of her personal token stake (which was 20% of the supply) to charity (Bhad Bhabie Launches $BHAD: A Community Token Built with Purpose By Chainwire) (Bhad Bhabie Launches $BHAD: A Crypto Token with a Purpose). The project emphasized that every transaction would contribute either to cancer research or to growing the token’s creative community, and Bhabie herself engaged fans via live Q&As and social media to build trust (Bhad Bhabie Launches $BHAD: A Community Token Built with Purpose By Chainwire) (Bhad Bhabie Launches $BHAD: A Crypto Token with a Purpose). In a bid to reward loyal supporters, she even invited the top 20 $BHAD holders to her 22nd birthday party, underscoring that this was “not about hype or quick profits” but about merging crypto with a real-world cause (Bhad Bhabie Launches $BHAD: A Community Token Built with Purpose By Chainwire) (Bhad Bhabie Launches $BHAD: A Crypto Token with a Purpose).

While the intentions sounded noble and the fanfare was high at launch, the actual market performance of $BHAD soon told a more cautionary tale. This token’s trajectory – from an initial surge to a rapid plunge – has become a textbook example of the speculative and high-risk nature of celebrity-backed cryptocurrencies.

Price History and Key Events of $BHAD

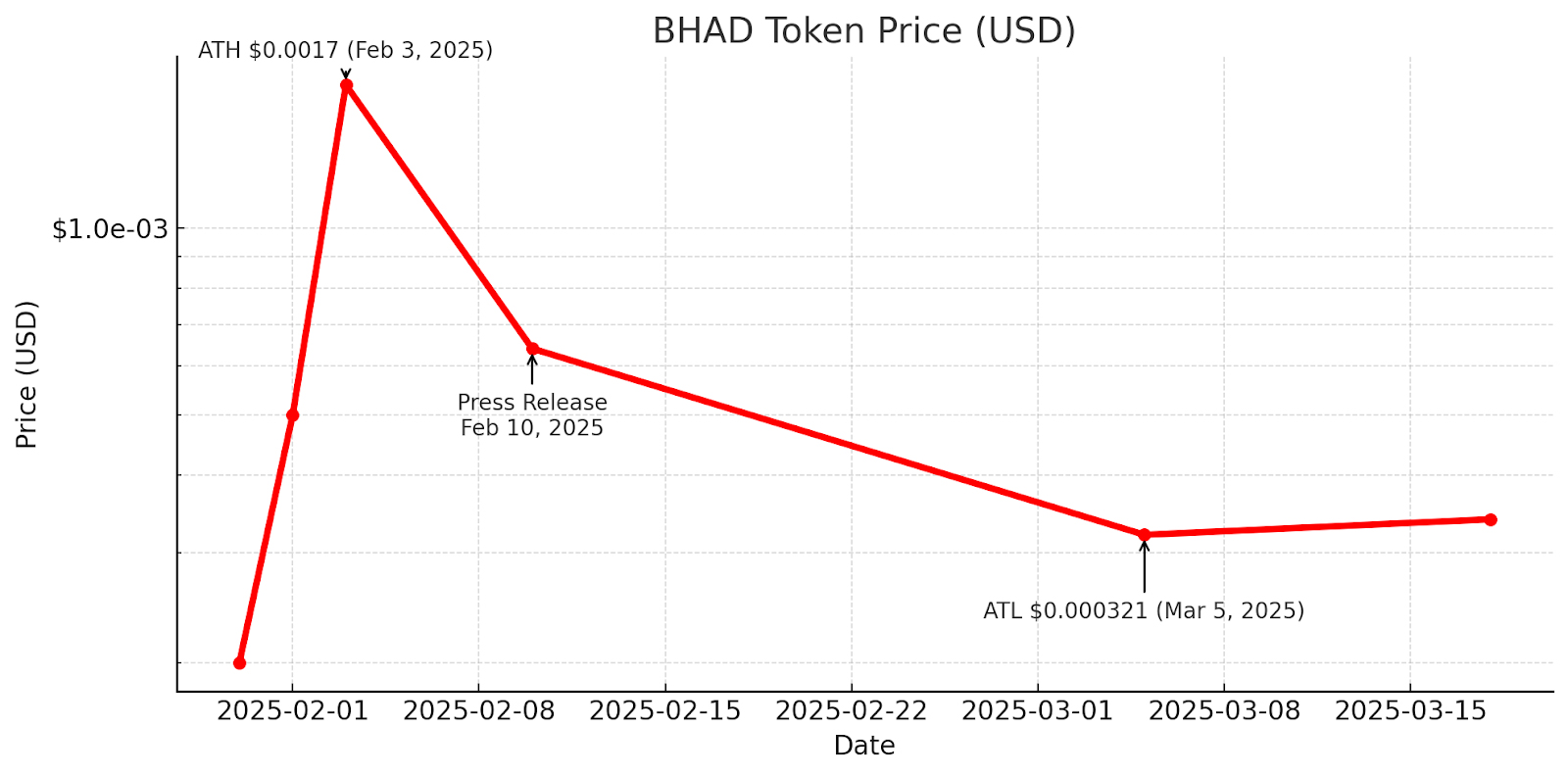

$BHAD began trading on decentralized exchanges in late January 2025, and within days it experienced a meteoric price spike. It reached an all-time high of about $0.001701 on February 3, 2025, reflecting intense early hype and buying interest (B.H.A.D Price Today - BHAD Price Chart & Market Cap | CoinCodex). This peak coincided roughly with the token’s launch buzz – a time when many fans and speculators rushed in, and positive news (including Bhad Bhabie’s promotional efforts) was at its height. However, the euphoria was very short-lived. After peaking in the first week, $BHAD’s value began falling sharply throughout February. By March 5, 2025, just one month after the high, $BHAD hit its all-time low at approximately $0.000321, marking a collapse of over 80% from its peak value (B.H.A.D Price Today - BHAD Price Chart & Market Cap | CoinCodex). In other words, most latecomers who bought near the top saw their investment virtually wiped out within weeks.

Figure: BHAD token’s price surged in early February 2025 and then crashed by early March, losing the majority of its value. This boom-and-bust pattern unfolded in roughly one month. (B.H.A.D Price Today - BHAD Price Chart & Market Cap | CoinCodex)

Several key events and observations accompanied this boom and bust cycle. Initially, the launch event and social media buzz around Bhad Bhabie’s involvement fueled a rapid run-up. Enthusiastic messaging about the token’s mission and exclusive perks (like the birthday party invite for top holders) created a sense of FOMO (fear of missing out) among fans. But soon after, reality set in as early investors and opportunistic traders likely took profits. By the time Bhabie’s team put out official press releases and updates in mid-February, the token had already significantly retraced from its peak. (Notably, a press release on Feb 10 touted the project’s vision even as the token traded around $0.0006 – already more than 60% off its high (Bhad Bhabie Launches $BHAD: A Crypto Token with a Purpose).) With diminishing hype and selling pressure mounting, $BHAD kept sliding. Liquidity on the Solana-based exchanges was limited, so even modest selloffs caused outsized price drops – a common issue with small community coins. By early March, when $BHAD bottomed out, it had lost four-fifths of its value, and trading volumes were a fraction of what they were at launch. A brief stabilization and small bounce occurred after hitting the low (the price recovered to ~$0.0006 at one point in mid-March), but overall the trend remained downward. CoinCodex data showed $BHAD “down 80% from [its] all-time high,” with extremely high volatility and a tiny market cap around a few hundred thousand dollars (B.H.A.D Price Today - BHAD Price Chart & Market Cap | CoinCodex) (B.H.A.D Price Today - BHAD Price Chart & Market Cap | CoinCodex). In essence, the initial frenzy gave way to a steep collapse – mirroring the fate of many meme tokens once the novelty wears off.

It’s worth noting that this decline happened despite the broader crypto market not seeing a comparable crash in that period. In fact, $BHAD underperformed the market and even its meme-coin peers during its fall. Over one seven-day stretch, $BHAD’s price dropped 16%, while the global crypto market was down only ~1.2% and similar “meme” cryptocurrencies were up about 7.7% on average (B.H.A.D Price: BHAD Live Price Chart, Market Cap & News Today | CoinGecko). This suggests the sell-off was largely specific to $BHAD due to waning enthusiasm, rather than just general market weakness. By late March 2025, $BHAD hovered in the $0.0003–0.0004 range – a far cry from its early-February high – with very low trading activity. The trajectory of Bhad Bhabie’s token thus far underscores how quickly a celebrity coin’s fortunes can reverse once the initial buzz fades.

The Speculative Nature of Celebrity-Backed Tokens

(File:Crypto Market Crash.jpg - Wikimedia Commons) Speculative and High-Risk: Celebrity-linked cryptocurrencies often undergo extreme boom-bust cycles, driven more by hype than fundamentals. Financial experts warn that investing in such tokens is highly speculative – prices can skyrocket on publicity and just as quickly plummet once excitement wanes (EMAX Crypto Has Lost 95% of Its Value Since Kim Kardashian Promoted It - Business Insider) (Experts Analyze the Appeal and Risk of Celebrity Memecoins in the Crypto Market | BeInCrypto Brasil on Binance Square). In the case of $BHAD, despite Bhad Bhabie’s genuine engagement and stated long-term goals, the token’s value ultimately rode the rollercoaster of investor sentiment. This aligns with a common pattern: an initial surge fueled by a star’s fanbase and social media buzz, followed by a crash when early promoters or insiders sell and new buyers dry up. Volatility is the norm for these projects. For instance, in $BHAD’s first month, its price swings were so drastic that CoinCodex labeled its volatility “extremely high” (over 44% volatility) (B.H.A.D Price Today - BHAD Price Chart & Market Cap | CoinCodex). Such wild fluctuations illustrate that these tokens trade on emotion and momentum more than any inherent value.

Crucially, celebrity endorsement doesn’t guarantee stability. Regulators have repeatedly cautioned investors not to be swayed solely by a famous name. The U.S. SEC even issued alerts about celebrity crypto endorsements, reminding people that even if a celebrity is involved, crypto investments carry significant risks and might be scams in some cases. As one SEC official put it, “It is never a good idea to make an investment decision just because someone famous says a product or service is a good investment” (Use Caution with Celebrity Endorsements of Investment Products). In many celebrity token debacles, the star’s involvement is limited to promotion, and they may not actively manage or support the project long-term. This means once the initial marketing push is over, there may be little to sustain the token’s value. In $BHAD’s scenario, despite Bhabie’s sincere interest, the token ultimately traded like any other meme coin – rising and falling on speculation. Investors who bought in had to be prepared for the very real possibility of losing most of their money. Expert insights consistently hammer this point: “There is little evidence that these [celebrity coins] can sustain their price or popularity over time. Typically, after a rapid appreciation, the price falls” (Experts Analyze the Appeal and Risk of Celebrity Memecoins in the Crypto Market | BeInCrypto Brasil on Binance Square). Without a strong use case or continuous external support, these tokens remain high-risk, short-term bets rather than reliable investments.

Comparisons to Other Celebrity Crypto Projects

Bhad Bhabie’s token is hardly the first celebrity-backed cryptocurrency to see a dramatic rise and fall. In fact, the landscape of celebrity crypto projects is littered with similar examples. Comparing $BHAD to these cases reveals recurring patterns and highlights the potential risks for investors:

- EthereumMax (EMAX) – Perhaps the most infamous example, EMAX was promoted by multiple celebrities (including Kim Kardashian and boxer Floyd Mayweather) in mid-2021. Kardashian’s Instagram shout-out prompted a surge in buying, but soon after, EMAX’s price collapsed. In the 16 months following her June 2021 post, **EMAX’s value plunged by 95%, turning a hypothetical $100 investment into barely $5 (EMAX Crypto Has Lost 95% of Its Value Since Kim Kardashian Promoted It - Business Insider). Eventually, EMAX lost over 97% of its peak value (Kim Kardashian Crypto Token Plunged Long Ago - WSJ), and it became the subject of lawsuits and regulatory scrutiny. The SEC fined Kim Kardashian $1.26 million for failing to disclose her paid promotion of EMAX, underscoring how the token was essentially propelled by hype before leaving late investors with heavy losses (EMAX Crypto Has Lost 95% of Its Value Since Kim Kardashian Promoted It - Business Insider).

- Dink Doink – A meme token launched in 2021 with involvement from YouTuber Logan Paul, Dink Doink followed a near-identical boom-bust trajectory. After Paul publicly endorsed the coin (calling it the “dumbest, most ridiculous sh--coin” but saying he was “all in”), the token’s price skyrocketed almost 40,000% in a frenzy (Dink Doink Coin Backed by Logan Paul Wants to Change World, Says CEO - Business Insider). Within two weeks, however, early investors dumped their holdings and the price crashed by over 90% (Dink Doink Coin Backed by Logan Paul Wants to Change World, Says CEO - Business Insider). Dink Doink quickly became valueless, and Paul distanced himself from the project amid criticism. This case showed how even a tongue-in-cheek, explicitly silly token can lure in speculators with a celebrity’s push – only for those speculators to get burned almost immediately.

- Centra Tech (CTR) – In 2017, boxing champ Floyd Mayweather Jr. and DJ Khaled promoted an initial coin offering (ICO) for a startup called Centra Tech, implying it was a hot opportunity. The ICO raised $32 million from investors riding on that star power. But soon after, Centra was revealed as fraudulent, its founders were indicted, and the token became virtually worthless. The SEC charged Mayweather and Khaled for unlawfully touting the coin (they hadn’t disclosed the hefty payments they received for promotion) (SEC.gov | Two Celebrities Charged With Unlawfully Touting Coin Offerings). This was an early warning that celebrity-backed crypto can be outright scams. Investors who bought in because “Floyd Crypto Mayweather” told them to, ended up with nothing as the project imploded (SEC.gov | Two Celebrities Charged With Unlawfully Touting Coin Offerings). Mayweather and Khaled paid fines, but that didn’t compensate the people who lost money. Centra Tech is an extreme case, but it reinforces the risk that some celebrity promotions hide serious fraud.

- Akoin (AKN) – Not all celebrity tokens start as blatant memes; some have ambitious goals. Akon, the R&B singer, launched Akoin with the vision of powering a crypto-city in Africa. Akoin briefly traded and even saw a peak around $0.58 in early 2021 (Akoin (AKN) Price History & Download Akoin Historical Data in CSV For Free | Bitget). However, despite Akon’s star power and the project’s grand plans, AKN failed to gain adoption. Over time its value dwindled to mere fractions of a cent – effectively a 99%+ loss from its highs (Akoin (AKN) Price History & Download Akoin Historical Data in CSV For Free | Bitget). This shows that even well-intentioned projects with real-world plans can leave investors holding the bag if execution falls short or interest fades. Being a celebrity doesn’t exempt a project from the unforgiving mathematics of supply and demand.

- Other Notable Mentions: Numerous other celebrities – from actors and rappers to influencers – have dabbled in crypto tokens or endorsements with similar outcomes. Rapper T.I. was involved with a token called FLiK in 2017 that promised to be a streaming platform currency; it ended in fraud allegations and the token’s collapse (T.I. settled SEC charges for promoting the “bogus” coin) (Rapper T.I. in $75000 U.S. settlement over cryptocurrency offering). Soulja Boy, Lindsay Lohan, Jake Paul, and others have been fined by regulators for promoting various crypto assets that nosedived, highlighting how widespread the trend of celeb crypto endorsements became, especially during the 2017 and 2021 crypto hype waves. Even when the projects themselves weren’t outright scams, the common thread is that early hype gave way to steep decline in token values.

Across these examples, a clear pattern emerges: celebrity-backed cryptocurrencies often enjoy a short-lived surge followed by a prolonged slump or total failure. Initial promotion can drive prices to irrational heights, but sustaining investor interest is exceedingly difficult once the novelty wears off or negative press arrives. Many celebrities themselves have faced reputational damage, lawsuits, or regulatory penalties as these ventures sour. Meanwhile, ordinary investors who bought the tokens hoping to “ride the wave” frequently ended up with heavy losses.

Patterns and Risks for Investors

Looking at Bhad Bhabie’s $BHAD and those comparable cases, the patterns are strikingly similar. Typically, a celebrity announces or promotes a new coin, triggering a spike as fans and speculators pile in. This is followed by a sharp decline – often leaving the token down 80–90% (or more) from its high within weeks or months. The drivers of this cycle are rooted in the speculative, momentum-driven nature of such tokens: they often lack strong fundamentals or long-term utility, so when the initial excitement fades, there’s little to prevent a freefall. Early insiders or big holders may sell for profit (“pump-and-dump” behavior), liquidity dries up, and new buyers become scarce. As Alvin Kan, an executive in the crypto industry, observed, “after a rapid appreciation, the price falls, as seen in recent launches… without broader utility or continuous community engagement, celebrity-backed coins are likely to remain speculative and short-term” (Experts Analyze the Appeal and Risk of Celebrity Memecoins in the Crypto Market | BeInCrypto Brasil on Binance Square). In other words, unless these projects manage to transform into something more than a celebrity novelty – by developing real use-cases or sustaining a passionate community – they tend to fizzle out fast.

For investors, the risks of celebrity tokens are manifold. First, extreme volatility means one can incur massive losses in a short time. $BHAD’s 80% plunge in a month and EMAX’s 95% wipeout in a year are testament to how perilous the ride can be (B.H.A.D Price Today - BHAD Price Chart & Market Cap | CoinCodex) (EMAX Crypto Has Lost 95% of Its Value Since Kim Kardashian Promoted It - Business Insider). Second, there is often information asymmetry – insiders or the project team might have large allocations of tokens, and if they sell (even if the celebrity face is unaware or not directly involved in those sales), the price tanks. Fans investing out of loyalty can be blindsided by such moves. Third, regulatory and legal troubles present another risk. If a token is deemed to be an unregistered security or if promotions don’t follow laws, the project can be shut down or fined. The involvement of authorities (like the SEC charging celebs in the cases of EMAX, Centra, Tron promotions, etc.) usually coincides with the token losing any remaining value as trust evaporates (SEC.gov | Two Celebrities Charged With Unlawfully Touting Coin Offerings) (EMAX Crypto Has Lost 95% of Its Value Since Kim Kardashian Promoted It - Business Insider). Essentially, investors not only face market risk but also the risk that the entire project could implode due to legal issues or loss of credibility.

Another important risk factor is the lack of oversight and transparency in many of these projects. While $BHAD was marketed as transparent and community-owned, many celebrity tokens aren’t so open – some hide the team’s token allocations or have vague roadmaps. Even in $BHAD’s case, despite good intentions, investors had to trust that the funds were indeed going to the stated causes and that the tokenomics were fair. In less scrupulous projects, promoters might make rosy statements that don’t hold true. For example, investors in Dink Doink were told Logan Paul was “all in” and that a whole cartoon ecosystem would grow, but little materialized before it collapsed (Dink Doink Coin Backed by Logan Paul Wants to Change World, Says CEO - Business Insider). Without rigorous accountability, these ventures carry high execution risk – it’s easy for a celebrity to lose interest or move on, leaving the project adrift.

Finally, there is the simple market reality: most of these tokens function as memecoins, whose value is driven by social media trends and virality. As such, they are prone to sudden sentiment shifts. A single negative news piece or a critical YouTube exposé can send prices spiraling. On the flip side, even if the celebrity stays involved, there’s no guarantee the broader crypto community will take the project seriously. Many seasoned crypto investors avoid celebrity tokens, viewing them as gimmicks, which limits the pool of potential long-term holders. This means the price is often propped up mainly by the star’s fanbase – a relatively narrow group – and if they lose confidence or interest, the demand evaporates.

In summary, investing in celebrity-backed cryptocurrencies is akin to gambling on a hype cycle. While it’s possible to make quick profits if you time the market perfectly, the odds are often stacked against latecomers. The dramatic rise and fall of Bhad Bhabie’s $BHAD token exemplifies this: even a well-meaning project can’t escape the gravity of market speculation. As crypto analyst Chris Chung noted, “You have a short-term spike, but unless [the project] shows some benefits or strong follow-through, it will disappear” (Experts Analyze the Appeal and Risk of Celebrity Memecoins in the Crypto Market | BeInCrypto Brasil on Binance Square). For most celebrity tokens so far, the “disappear” phase has indeed been their fate.

Conclusion: A Cautionary Tale

Bhad Bhabie’s foray into cryptocurrency with $BHAD provides a cautionary case study of what can happen when pop culture and crypto speculation mix. While her involvement lent the project initial credibility and a burst of popularity, the token’s collapse in value underscores that celebrity status is not enough to sustain a cryptocurrency. The neutral reality is that $BHAD’s performance has mirrored the boom-and-bust pattern seen in many similar tokens – rapid appreciation fueled by hype, followed by a precipitous decline once reality sets in. This says nothing negative about Bhad Bhabie’s personal intentions; rather, it highlights the inherently volatile, high-risk nature of the crypto market segment she entered.

For investors and fans, the key lesson is to approach celebrity crypto projects with healthy skepticism. The glitz of a famous name or a heartfelt narrative can obscure the fact that you’re often buying into an untested, speculative asset. Historical data from other celebrity tokens (and now $BHAD’s own history) shows that the odds of long-term success are slim. Many have ended in dramatic price crashes, and some in outright failure. As experts have emphasized, these investments are more akin to speculative gambles than sound investments (EMAX Crypto Has Lost 95% of Its Value Since Kim Kardashian Promoted It - Business Insider) (Experts Analyze the Appeal and Risk of Celebrity Memecoins in the Crypto Market | BeInCrypto Brasil on Binance Square). Anyone considering such tokens should only invest money they can afford to lose, and must do thorough due diligence – looking beyond the celebrity endorsements to the actual project fundamentals (if any exist).

Ultimately, Bhad Bhabie’s crypto venture serves as a reminder that in the world of cryptocurrency, celebrity hype can ignite a fire, but it can just as quickly burn out. The market’s verdict on $BHAD so far has been harsh, echoing the fate of EthereumMax, Dink Doink, and numerous others. While the token is not necessarily “dead” and could theoretically stage a comeback if the team delivers on its promises, the overwhelming message from its journey is one of extreme caution. Investors should view any celebrity-backed coin – no matter how intriguing the story or how big the name – through the lens of sobriety: as a high-risk speculation riding on popularity and sentiment. In the end, the fundamentals of investing remain unchanged; as the saying goes, “Don’t invest in something you don’t fully understand or believe in – even if you “cash me outside” of traditional finance.” (In this case, those who didn’t fully understand the risks got cashed out in a hurry.)

Key Takeaway: Celebrity crypto projects like $BHAD can be exciting and draw a crowd, but their track record is largely one of hype-fueled spikes and crushing collapses. Maintaining a neutral view of the celebrity’s involvement – neither blindly trusting nor unfairly blaming them – allows us to focus on the underlying economics. And those economics suggest these tokens are ultra-speculative. Investors should be prepared for extreme volatility and the potential for significant loss, making due diligence and caution absolutely essential when navigating this risky intersection of fame and finance.

Sources: The information above is based on reported price data, market analysis, and expert commentary from cryptocurrency tracking sites and news outlets (B.H.A.D Price Today - BHAD Price Chart & Market Cap | CoinCodex) (EMAX Crypto Has Lost 95% of Its Value Since Kim Kardashian Promoted It - Business Insider) (Dink Doink Coin Backed by Logan Paul Wants to Change World, Says CEO - Business Insider), as well as case studies of other celebrity-linked crypto ventures documented by reputable financial news sources (EMAX Crypto Has Lost 95% of Its Value Since Kim Kardashian Promoted It - Business Insider) (SEC.gov | Two Celebrities Charged With Unlawfully Touting Coin Offerings). These examples collectively paint a comprehensive picture of the trends and risks associated with celebrity-backed tokens.